Are you ready to dive into the fascinating world of account? Whether you are an aspiring accountant or simply curious about how businesses keep their fiscal records in check, understanding the accounting cycle is essential. suppose it is a well-choreographed cotillion that allows companies to track and dissect their fiscal deals effectively. In this blog post, we will unravel the riddle behind the accounting cycle and break down each step, so you will no way have to wonder again” How numerous ways are there in an accounting cycle?” In this blog post, we will tell you the Steps in Accounting Cycle.

Introduction to the Steps in Accounting Cycle

The Steps in Accounting Cycle is the process that companies use to record and report their fiscal deals. It generally consists of four main ways recording, classifying, recapitulating, and reporting.

Recording refers to the process of entering deals into the company’s account records. This step is generally done using double- entry secretary, which means that each sale is recorded in two accounts. For illustration, when a company buys inventories on credit, it would record the sale in both the Accounts Payable and inventories Expense accounts.

Classifying refers to the process of sorting deals into different orders. This step is necessary in order to prepare fiscal statements that directly reflect the company’s fiscal conditioning. For illustration, all profit deals would be classified under the heading” profit” on the income statement, while all charges would be classified under the heading” Charges.”

recapitulating refers to the process of creating a condensed interpretation of the company’s fiscal deals. This step is generally done at the end of an accounting period, similar to a month or a time. fiscal statements are one type of summary that companies use to communicate their fiscal position to shareholders and other interested parties.

Reporting refers to the process of participating in fiscal information with interested parties. This step generally takes place after recapitulating and can take numerous different forms, similar to issuing press releases or filing fiscal statements with nonsupervisory agencies.

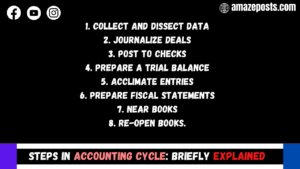

Steps in Accounting Cycle

There are generally eight steps in Accounting cycle, although the precise number may vary depending on the association.

1. Collect and dissect data

2. Journalize deals

3. Post to checks

4. Prepare a trial balance

5. Acclimate entries

6. Prepare fiscal statements

7. near books

8. Re-open books.

– assaying Deals

There are four Steps in Accounting Cycle relating, recording, recapitulating, and presenting fiscal data.

The first step, relating, is important because it ensures that all of the deals that need to be recorded are reckoned for. The alternate step, recording, involves entering the fiscal data into the accounting system. The third step, recapitulating, is when the data is organized and anatomized. In the donation step, the fiscal information is presented in a way that’s easy to understand.

The purpose of the accounting cycle is to give accurate and over-to-date fiscal information about a company. This information is used by operations to make opinions about how to run the business.

The accounting cycle helps to ensure that all fiscal deals are recorded directly and in a timely manner. It also provides a base for assaying the fiscal performance of a company, as well as furnishing an inspection trail for adjudicators. Eventually, it helps ensure that all levies are paid on time.

– Journal Entries

This is one of the most important Steps in Accounting Cycle. In account, a journal entry is the recording of a fiscal sale in a company’s books of account. Journal entries are made in a company’s general tally or attachment checks, which form the company’s double-entry secretary system.

In double- entry secretary, every fiscal sale is recorded in at least two accounts. The journal entry for a sale includes the date of the sale, the quantities debited and credited, and a brief description of the sale. Journal entries are posted to tally accounts at the end of an account period.

utmost journal entries in double-entry secretary are made using the addendum system, which records deals when they do, anyhow of when payment is made. Under the addendum system, profit is honored when it’s earned, not when it’s entered. Charges are honored when they’re incurred, not when they’re paid.

For illustration, if a company sells goods on credit, the journal entry for the sale would be recorded when the goods are packed, not when the client pays for them. The journal entry would include a disbenefit to Accounts Receivable and a credit to Deals profit. When the client pays for the goods, another journal entry would be made to record that sale. This journal entry would include a disbenefit to Cash and a credit to Accounts Receivable.

– advertisement to Ledger Accounts

Assuming that the anthology has an introductory understanding of accounts, we will now bandy posting to tally accounts. This is the alternate step in the accounting cycle and is frequently done coincidently with Step 1( relating deals).

When posting to tally accounts, we’re basically transferring information from the journal to the applicable checks. For each sale that was recorded in the journal, we need to record it in the applicable tally account. This ensures that all fiscal information is accurate and over-to-date.

There are two types of tally accounts – particular and nominal. particular tally accounts relate to specific individualities or realities, similar to guests or suppliers. Nominal tally accounts, on the other hand, relate to broader orders of income or expenditure, similar to rent or hires.

To illustrate this conception further, let’s take a look at an illustration journal entry

Debit Credit

Rent$ 500

serviceability$ 100

Total$ 600

In this case, we’d need to post$ 500 to the ‘ Rent ’ nominal tally account and$ 100 to the ‘ Utilities ’ nominal tally account. We’d not post anything directly to a particular tally account as there are no specific individualities or realities involved in this sale.

– Acclimated Trial Balance

An acclimated trial balance is a report that lists all of the account balances in a company’s general tally after conforming entries have been made. conforming entries are journal entries made at the end of an accounting period to correct crimes and to bring account balances up to date.

After the conforming entries have been made, the accountant prepares an acclimated trial balance. This report lists all of the account balances in the tally, including both the disbenefit and credit sides. The purpose of this report is to check for fine delicacy and to make sure that the total disbenefits equal the total credits.

still, also there’s an error nearly in the account records If the summations on the acclimated trial balance aren’t equal. Chancing and correcting this error is important because it can lead to inaccurate fiscal statements.

– Income Statement & Balance distance Preparation

This is one of the most important Steps in Accounting Cycle. Income statements and balance distance medication are the final way in the accounting cycle. Income statements show a company’s earnings, charges, and net income for a period of time. Balance wastes show a company’s means, arrears, and equity at a point in time.

The medication of an income statement and balance distance begins with the recording of all deals. All deals are recorded in a journal, which is also posted to colorful accounts in the general tally. formerly all deals have been recorded, conforming entries are made to ensure that fiscal information is reported directly. At the end of an account period, conforming entries are reversed and closing entries are made to move any remaining balances from temporary accounts to endless accounts.

Once all the journal entries have been prepared and acclimated, an income statement can be created. This is done by recapitulating earnings and charges for a period of time into one statement showing net income( or loss). A balance distance is also created by taking a shot of a company’s means, arrears, and equity as they was at the end of the period being reported on. This provides druggies with precious sapience into how financially healthy a company is at any given point in time.

– ending Entries

This is one of the most important Steps in Accounting Cycle. Ending entries are made at the end of an account period to zero out all temporary accounts and transfer their balances to endless accounts. This ensures that the balance in each temporary account is equal to zero at the launch of the new period. Without closing entries, the balance in each temporary account would carry over to the coming period, which would distort your fiscal statements.

exemplifications of closing entries include

• disbenefit Cost of Goods vented and credit force for the cost of goods vented during the period.

• Debit profit and credit Accounts Receivable for any uncollected client payments.

• disbenefit stipend expenditure and credit stipend Outstanding for any overdue stipend.

• disbenefit Retained Earnings and credit tips Paid for tips paid to shareholders.

– Post-ending Trial Balance

A post-ending trial balance is the last step in the accounting cycle. It’s a summary of all the account balances after the ending entries have been made. This trial balance is used to make sure that the books are in balance and to prepare for the coming account period.

The post-ending trial balance generally includes the following accounts

Asset Accounts Cash, Accounts Receivable, Inventory, Prepaid Charges, Equipment, Vehicles

Liability Accounts Accounts Payable, Notes Payable, Accrued Charges

Equity Accounts Common Stock, Retained Earnings

profit and Expense Accounts Sales profit, Rent Expense

Conclusion

As you can see, there are several ways in an accounting cycle. It’s important to understand each step and its purpose in order to duly use the accounting system. The eight ways of the accounting cycle insure that all fiscal data is directly recorded, reported, and maintained for a business. With this knowledge, you should now have a better understanding of how important ways are in an accounting cycle.

Riding the Metaverse Wave: Investing Opportunities in Virtual Economies

Riding the Metaverse Wave: Investing Opportunities in Virtual Economies  Navigating Market Volatility: Strategies for Investors in Uncertain Times

Navigating Market Volatility: Strategies for Investors in Uncertain Times  The Future of Banking: Exploring Digital Currencies and Central Bank Digital Currencies (CBDCs)

The Future of Banking: Exploring Digital Currencies and Central Bank Digital Currencies (CBDCs)  The Role of Decentralized Finance (DeFi) in Reshaping Traditional Banking Systems

The Role of Decentralized Finance (DeFi) in Reshaping Traditional Banking Systems  WHAT IS FINANCE : It’s aspects & importance in an organization

WHAT IS FINANCE : It’s aspects & importance in an organization  Car Finance Manager Salary: What to Expect in Today’s Market?

Car Finance Manager Salary: What to Expect in Today’s Market?